We’re excited to present our new feature column, Industry Focus. Each issue will feature a different vertical and shine a spotlight on industry-specific issues that influence research design and project execution. Our goal is to share best practices within an industry, that can also be shared across industries. Tom Neveril, new feature editor for this column, has penned the first article focused on the CPG industry.

~Tamara Kenworthy, Managing Editor

Since the mid-2010s, all of the leading consumer packaged goods (CPG) marketers have been investing in knowledge management and sharing platforms for their marketing intelligence. When paired with skilled staff, these market insight platforms allow companies to store, analyze, and widely share research project inputs and outputs.

Importantly, these systems are far more than a passive, well-organized digital library. They use artificial intelligence and machine learning to connect the dots between disparate sources of data. They also provide the infrastructure to help insights professionals proactively distribute more powerful consumer insights.

The move to adopt the market insight platforms by so many CPG leaders in the space of a few years was most likely driven by the arrival of Amazon and e-commerce. From 2013 to 2018, the online channel was still below 10 percent of total CPG sales but generating 40 percent of its growth. By 2018, large CPG companies, on average, had online market shares that were at least 5 to 10 percentage points below the shares they enjoyed in the brick-and-mortar world. http://bit.ly/VIEWS-CPG-Online-Sales

The fact was that traditional CPG marketers were falling behind on consumer trends in the 2010s. For example, Gen Z and millennials led the trend toward more personalized brand experiences. Consumers around the world started seeking smaller, culturally-aligned brands, private labels, and ecologically driven models like farm-to-table.

Upstart CPG competitors with direct-to-consumer and e-commerce business models were starting to develop more personal, data-rich customer relationships. Consider Harry’s, the trendy direct-to-consumer razor club. It grew 35 percent year-on-year from 2014 to 2016, three times faster than the industry average, commanding 9 percent of all online razor sales. http://bit.ly/VIEWS-HBR-Big-Consumer-Brands

Why Market Insight Platforms Will Soon Become the Norm within CPG

When the COVID-19 pandemic hit, shopping online took off in all sectors, including CPG. According to NielsenIQ, by the end of 2020, consumers had spent $110 billion on CPG products via online channels over the prior year; an increase of 50 percent! Forty percent of U.S. households shopped for CPG products both in person and online, an increase of 13 percent in just one year. http://bit.ly/VIEWS-NielsenIQ-Tech-Adoption

Meanwhile, market share from the top thirty CPG marketers (selling mostly through brick-and-mortar retail) continued to fall, from 51.2 percent to 50.5 percent in 2020. http://bit.ly/VIEWS-McKinsey-CPG-Outlook. As a result, traditional CPG leaders are under more pressure than ever to shore up data weaknesses and extract insights from their sophisticated marketing machines.

Elizabeth Morgan, CMO of Market Logic, the largest market insight platform provider, explained that CPG clients use these platforms to spread insights across more stakeholders. “If I’m a researcher, I do maybe ten ad hoc projects a year with a handful of stakeholders. But when there are many more people to serve, there’s no way I’m going to be able to do projects with all of them. In CPG companies today, I need to leverage the project across the brand and commercial organizations, different categories, and different regions. Then I’m talking about a stakeholder relationship that can’t be serviced by a specific project. And that’s where you need insights delivery as a capability, not as an individual project result.”

For a client perspective, I also interviewed Daniel Stradtman, formerly of Walmart and GE, and current vice president of consumer and market insights for Berkshire Hathaway-owned Lubrizol, a chemical company serving many CPGs and manufacturers. He offered this piece of advice for qualitative researchers: “Market insights platforms are reaching the mass-adoption phase. Everyone knows that they were being rapidly rolled out at companies like Coke, General Mills, and Unilever. But now they’re also coming to smaller, non-CPG companies as well because as corporate insights leaders, we are looking for ways to show a return on investment on every dollar we spend. Market research and insights work has always been under the microscope in this way, but now these knowledge management systems can provide usage analytics that gain new visibility into who’s using what, when, and how. This helps us make the case for more investment in the most impactful things—we can tell a story that a body of insights work is truly valuable when the right people have looked at it, and it’s translating into measurable results for those stakeholders.”

Following, I’ve identified some of the notable features of market insight platforms and proposed some best practices for market researchers as they help CPG clients maximize their potential. It’s just a matter of time until this type of platform is more broadly utilized across other industries.

Notable Feature 1:

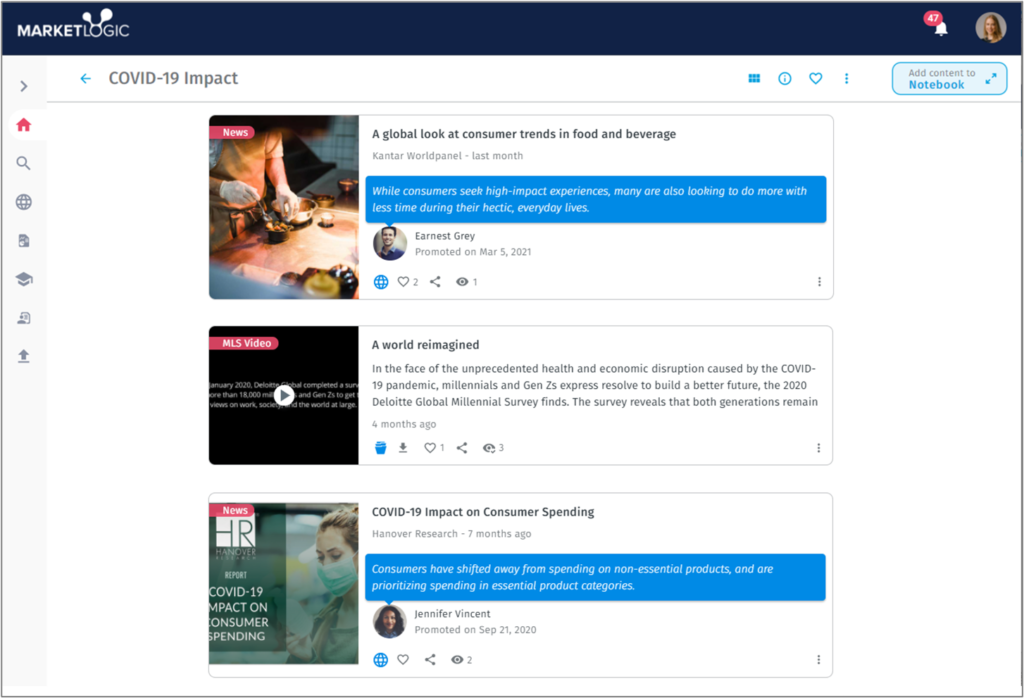

Social Media-like Posts for Insights

The purpose of these platforms is to help users more quickly extract insights, curate them with storytelling, and then proactively push them to stakeholders throughout the business. To achieve this, the platforms encourage researchers to walk away from PowerPoint decks, which often contain content that can’t be easily digested, indexed, or searched.

Instead, the platforms require researchers to upload thinking into a format that we’re all familiar with: the social media post. All of the leading platforms provide templates for posting insights in self-contained, bite-sized chunks. They’re optimized for displaying on phone screens, as well as on larger devices.

Specifically, each platform provides researchers with posting templates containing a consistent structure: They typically lead with an insight headline, followed by a concise description of the findings that support the insight, usually in bullet points. The text will often contain hyperlinks to other key data sources that support the insight.

From that point, insight posts or “stories” as they’re sometimes called, are very similar to social media posts. They often include supporting videos, photos, illustrations, or audio. They usually conclude with social media elements, such as the ability to share, like, rate, and/or comment. Interactive elements like polling are also possible. Views are counted, and sometimes viewers are listed/tracked. Lastly, the subject matter is automatically tagged or indexed by target audience criteria, product type, and other key project specs.

Best Practices:

Demonstrate Subject Matter Expertise

Within market insight platforms, the social media-like posts will need to stand on their own without project background information. They must be coherent and credible because platform users are unlikely to read entire project reports. More often, users are going to query the system which will return a list of related insight posts. As a result, insights will be evaluated against other related insights.

Therefore, qualitative researchers need to embrace these platforms, reading other related content, linking to other content, and anticipating questions. With all of the commenting and interactive capabilities, qualitative researchers need to be prepared for scrutiny. Subject matter expertise will be more critical than ever for credibility.

Taking things a step beyond hyperlinks, qualitative researchers may also use the platforms to curate “knowledge zones” or areas of related insights. These may be from primary research or from a mixture of sources. For example, researchers might connect the dots between desk research, social listening, and business intelligence data to develop new insights. This is where a qualitative researcher begins to earn a reputation as a strategic thinker and trusted advisor, rather than a vendor or supplier.

Capture and Present Powerful Video Clips

Social media-like posts are a natural fit for qualitative researchers who’ve spent their careers creating and editing clips. However, the recent popularity of Instagram stories and TikTok videos has raised everyone’s expectations. Research clips need to make a clear point in as little time as possible. And, of course, they need high-definition video and excellent audio. With HD recorders in everyone’s hands, and 360-degree HD video recording equipment widely available, the days of standard definition, stationary cameras are long gone.

But those are just the basics. Qualitative researchers need to think like journalists before, during, and after the qualitative sessions. First and foremost, they need to prevent distractions from making their way into audio and video. They have to consider the background of the shot and what else is happening in the area. They need to be vigilant for quirks in the respondent’s mannerisms and delivery.

Perhaps most importantly, qualitative researchers need to consider how to evoke powerful testimony from respondents. If a respondent has communicated nonverbally only, the moderator may want to continue probing for a verbal response with a questioning technique like, “Please complete this sentence.” Researchers may also conduct follow-up IDIs with respondents who are especially articulate or demonstrate behaviors that strongly support an insight.

While the right clip can make a huge difference in the overall power of a social media-like post, the search for them should never bias a study. Having “a flair for the dramatic” is not a good idea. Methods need to remain strategically sound and always encourage authenticity in the respondents.

Notable Feature 2:

Qual Session Content Searchable by Transcript Text

One of the key features of these platforms is automatically transcribing video and audio files and indexing all of the transcribed content. The intention is making raw data easily searchable and democratizing market intelligence.

The software companies that sell these platforms pitch marketers/customers with the claim that platform users can mine their qual video archives for new insights. In fact, in another interview for this article, an executive from one of the newer platforms proudly demonstrated how it worked. He typed a keyword query about what people preferred in a given category. Within seconds, I was watching a video clip from a focus group with participants discussing preferences and using the same keywords.

I believe this capability, while well-intentioned, provides little benefit beyond helping users quickly find sections of qual session content. More importantly, it comes with some serious drawbacks.

First of all, transcripts—especially machine-based transcripts—depend on audio quality and are often highly inaccurate without considerable editing.

Secondly, and even more importantly, transcription-centric indexing relies on literal interpretations of transcripts. However, transcripts are blind to tonality, nonverbal-expressed emotion, and nonliteral meaning. Therefore, search results are unlikely to capture what was really being communicated during the sessions.

Qual Session Content Searchable by Sentiment Analysis or Object Recognition

Qual Session Content Searchable by Sentiment Analysis or Object Recognition

Some of the market insight platforms offer integrations with video sentiment analysis or even object recognition technologies. Voxpopme or Affectiva are examples of innovators in this arena. Today, their most promising application is reading faces for copy testing research.

However, as fascinating as these technologies are, they’re limited to a literal interpretation of data. So, just like transcript analysis, none of them are able to interpret participant intentions when there is subtext, posturing, or sarcasm. They can’t gauge the influence of groupthink, cultural influences, or external events.

For example, are the respondents laughing at the television commercial because they’re sincerely entertained or because they think it’s laughably bad? Is the respondent sitting with arms folded because she’s cold or because she’s feeling anxious?

These technologies are years away from having the emotional IQ necessary to accurately process all of the input that we process naturally, in real time.

Best Practice:

Consistently and Concisely Explain the Other Factors that Influence Interpretation of Respondents, Beyond Their Words

With far wider access to insights, a greater share of the audience will be unfamiliar with qualitative research interpretation. Expect users of the market insight platforms to be highly focused on “what the participants said” in the transcripts. Or perhaps users may reference facial recognition-derived sentiment data.

When explaining findings and insights, qualitative researchers need to capture the totality of what was expressed. We need to demonstrate expertise in identifying and describing the behaviors and microexpressions that communicate subconscious thought. A book like What Every BODY is Saying: An Ex-FBI Agent’s Guide to Speed-Reading People, by Joe Navarro and Marvin Karlins, should be in every qualitative researcher’s library.

Qualitative researchers also need to concisely explain the contextual issues that influence interpretation. These might include in-session factors like previous interactions, research stimuli, conversational undercurrents, and group dynamics (in focus groups). Contextual issues could also include cultural trends and news events. For example, if a research participant has had a terrible customer service experience, or a brand has recently been engulfed in a public relations crisis, these key considerations need to be referenced. This is where hyperlinks play a critical role, so platform users can quickly investigate any relevant websites or documents.

Lastly, researchers need to concisely explain how business issues influence interpretation. Glen Kristensen, a strategy director at Hall & Partners, summarized: “Good qualitative is not simply regurgitating what consumers said after we’ve asked them questions. Good qualitative reporting analyzes what the consumers have said and combines it with an understanding of branding, marketing, and the category. Then it collides that with the business question that led to the project being commissioned in the first place.”

Notable Feature 3:

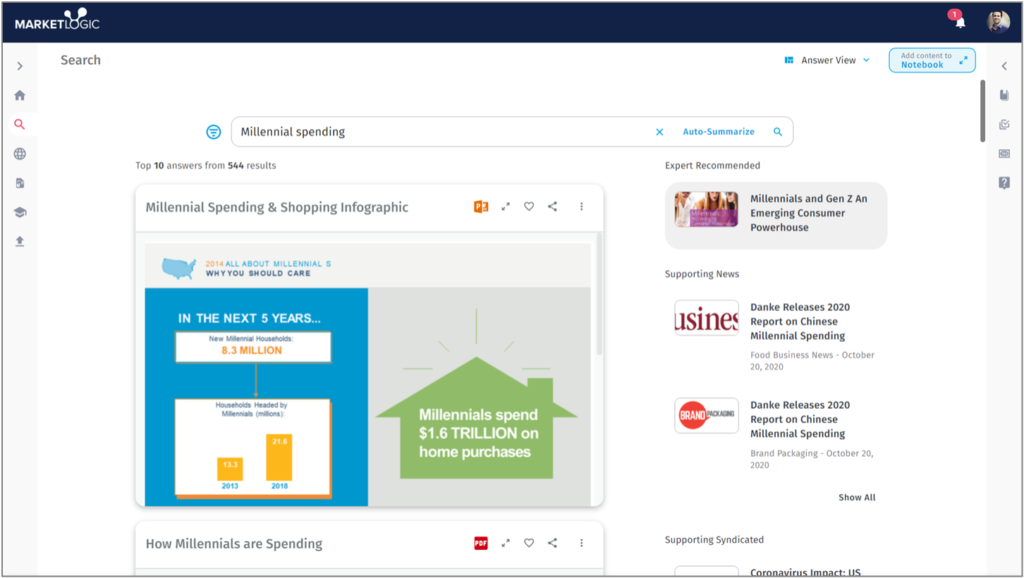

Capability to Track User Queries, Views, and Activity

Increasingly, users of these platforms are not reading filed project reports or sitting through project presentations in hopes of hearing an insight that will apply to their business. Instead, they will query the system for an answer to a specific question.

All market insight platforms allow client teams to track these user queries. The platforms track the words used in queries, which results were returned, which results were viewed, and any interaction with the results. The platforms also track and tally all queries that returned zero results. If users are consistently searching for an answer to a question, and not getting one, this represents fertile ground for planning new research. Some of the platforms are configured to initiate a new project brief in these situations.

Tracking user activity allows the platforms to serve up more personalized content. Tracking queries helps insights managers fine-tune project objectives to align with the needs of individual stakeholders. Like LinkedIn and other social media platforms, users can follow topics and are alerted when their contributions generate other user interactions.

External qualitative researchers would no doubt benefit from greater visibility into this data. Whether these researchers will have access to queries and other user activity is an open question. It depends on the strength of the consultative relationship.

Market Logic’s Elizabeth Morgan explained, “We’ve always supported research agencies having access to the platforms to be able to see things. The security controls allow access to a specific topic or a basket of information or to just their own research that they deliver. So, there are many ways that the platforms can be configured to give a trusted partner access. But the client has to want to give you the access.”

Best Practice:

Use the Platform to Learn about the Client’s Language, Jargon, and Acronyms

Qualitative researchers—internal or external—would be wise to request visibility into queries, user views, and activity. This would provide a clear view into the organizational culture, especially how people outside of the insights team talk about business issues and research targets. Leaning into an organizational culture is a simple way to communicate both enthusiasm and expertise.

It is important to remember that organizations often speak differently about consumer issues than the consumers themselves. Moderators should be able to translate “company speak” into qualitative explorations that consumers easily understand. Moderators also need to translate consumer feedback back into language that the organization understands. Making a concerted effort to use each audience’s language is a great way to boost your effectiveness and ultimately earn client trust.

Conclusion

One could argue that large CPG marketers have needed these market insight platforms for a long time. They typically operate with huge marketing data sets dispersed around the world, within a complex matrix of distinct brands, products, retailers, and segments.

One could also argue that qualitative researchers have needed these platforms to push us to improve the effectiveness of our deliverables.

The 2020 GRIT report (www.greenbook.org/mr/grit) showed that research buyers aren’t nearly as impressed with our reporting as we are. Specifically, the GRIT report identified the areas in which market research suppliers’ level of satisfaction with their own performance differs from buyers’ satisfaction with supplier performance.

By far, the biggest area of supplier overconfidence is “data visualization,” with a gap of 41 percent (70 percent of suppliers were satisfied versus 29 percent of buyers). The next biggest areas of supplier overconfidence are “recommending business actions” with a 20 percent gap (51 percent versus 31 percent) and “reporting research results,” with an 18 percent gap (67 percent versus 49 percent). It’s worth repeating this last data point: only 49 percent of surveyed clients reported being satisfied with suppliers’ “reporting research results.”

Ultimately, the way for qualitative researchers to differentiate themselves is through better reporting and strategic recommendations. The GRIT report showed that most clients are satisfied (80 percent) with how research is conducted. I would argue that quality research methodology is increasingly table stakes. I’d also argue that this is especially true in CPG, where the companies have spent decades and vast resources exploring ubiquitous human needs. They know methodology inside and out. They need people who can transform research data into guidance on growing their businesses.

So, what will you do with your next CPG project? Will you deliver an impenetrable PowerPoint deck beautifully adorned with your logo and unsplash.com imagery? Or will you dive into your client team’s market insight platform, adapt your research and reporting accordingly, and take your client relationship to the next level?

If you work with clients other than CPG, what can you do to help your clients create a broader insights library?

Be the first to comment