By Fiona Ray

Founder and Chief Researcher, Ready About Insights, Chicago, Illinois,

fionaray@readyaboutinsights.com

Have you ever bumped into a situation like this? “We need to better understand our ‘Curious Optimist’ audience, or it’s important we capture the ‘Time-pressed Tina’ segment point of view.” You may get a brief description or a typing tool (aka algorithm) to identify this target, but it still feels pretty ill-defined and abstract. If so, you may be encountering one of the shortcomings of a purely data-based segmentation study.

This article is a guide on how to successfully approach segment typing tools and profiles, and best practices for qualitative research in segmentation studies. With qualitative research, we can illuminate a flat, numbers-based segment to create a nuanced, rich, relevant, and truly useful portrait of the consumer segment.

What Is a Segmentation Study?

Segmentation studies are ideally designed to enable brands to define their most promising target customers. At their best, by identifying distinct target segments and the differences between them, they help brands develop more effective and targeted marketing strategies, and customized product offerings. Segmentation studies are most often commissioned when brands are planning entry to new markets or categories or responding to changing consumer preferences in evolving categories.

While a successful segmentation study can be a powerful foundation for guiding brand strategy and resource allocation, the process of conducting one can be lengthy and expensive. They typically involve large-scale custom quantitative studies and complex statistical analysis. Terms like cluster, conjoint, discriminant, and regression analysis are the norm (pun intended!). Recently, big data and AI have also entered the picture, identifying segments based on huge volumes of behavioral/transactional data and predictive analytics.

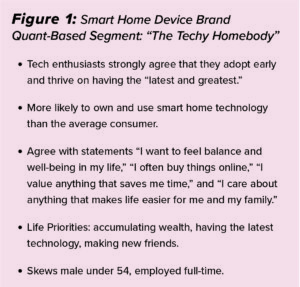

In either case, the outcome is typically the aforementioned data-driven profile of each segment, which is built on common characteristics, such as demographics, category attitudes, behaviors, needs, and brand perceptions. As illustrated by the example in Figure 1, those of us who have grappled with these profiles in the past know they can be fuzzy and lacking in a genuine human perspective.

In either case, the outcome is typically the aforementioned data-driven profile of each segment, which is built on common characteristics, such as demographics, category attitudes, behaviors, needs, and brand perceptions. As illustrated by the example in Figure 1, those of us who have grappled with these profiles in the past know they can be fuzzy and lacking in a genuine human perspective.

Avoiding the Pitfalls of Segmentation Typing Tools (aka the “Dreaded Algorithm”)

The “typing tool” is an algorithmic output of the quantitative study that is used to place a consumer into one of the identified segments-based scaled questions. At times, they seem like the trolls of post-segmentation qualitative work, causing hassle and headaches. The problem is that many typing tools do not work well on their own to accurately classify consumers; they often have large margins of error and cannot adequately capture the key attributes of each segment.

Because the typing tool is often a key output of the significant investment of the quantitative study, many stakeholders consider it a “done deal.” They may insist it is used as the primary segment identifier in the qualitative screener.

Top Tip: Do not rely on the typing tool alone to recruit for individual segments.

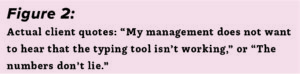

It may come back to haunt you! Imagine fielding an entire study, only to discover that most of your participants did not fit their segment profile nor seem to have anything in common with others in the same segment. Take it from my experience—as you can see from Figure 2, stakeholders do not want to hear their typing tool isn’t working!

Working with and around Typing Tools

The typing tool is typically provided as an Excel sheet with an embedded macro that segments participants based on their responses to several (ideally three to six) qualifying scaled questions. As such, the tool lacks nuance and accuracy. For example, it may assign a participant to one segment versus another based on one Likert scale point difference on one question. Thus, it is important to take a holistic approach to recruiting participants who best represent each segment.

- First, thoroughly understand the quantitative segment profiles.

- Carefully read the entire quantitative report.

- If possible, have the quantitative team explain their findings.

- Ask questions and seek clarifications to fully understand the segment descriptions and associated drivers and attributes.

- Master the typing tool.

- Work with your brand stakeholders and the quant team to understand how the typing tool works and the defining values for each segment.

- Inquire about areas of overlap between the segments and make sure you are clear on the differences between the segments: what makes each unique?

- Test it out first.

- Test the typing tool on yourself; does your assigned segment hold true?

- Run a trial of the typing tool with colleagues, friends, and family.

- Call stakeholders’ attention to any noticeable misalignments.

- Carefully build and adapt the screener.

- Add profile-defining questions that the typing tool doesn’t cover.

- Use scaled questions to capture the key segment attributes and attitudes.

- A well-crafted articulation question can help verify a participant’s segment assignment.

Ask participants to describe their “segment” with an open-ended question that summarizes their attitudes and behavior in relation to the brand’s category and key segment drivers. For example, for a home security system brand segmentation, we asked, “Please describe your approach to home security. What do you do to keep your home secure? What do you think is most important?”

- Consider adding a video “audition” as a final step to the screener.

Once you have identified potential participants who fit a segment profile, if possible, ask for a final video submission.

Make it simple: ask them to answer three short questions related to the category, expanding on the articulation question.

This can be another tool to help you choose the strongest participants who are able to express themselves well as “representatives” of their segment.

Where Qualitative Can Play a Role

In an ideal world, qualitative research would be fully integrated into every segmentation study. Unfortunately, given the expense and focus on the quant work, qualitative can sometimes be an afterthought with a limited budget or brought in late in the process.

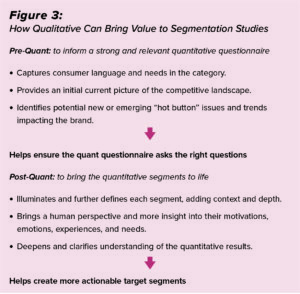

It is important to highlight to stakeholders the positive impact qualitative research can have on segmentation studies (Figure 3), particularly given their high-stakes nature.

Pre-Segmentation Qualitative: Best Practices for Informing Quantitative Questionnaires

Starting with qualitative research can help to shape a far more relevant and effective quantitative questionnaire. As you design your approach, aim for a research plan that is:

- Collaborative

- Engage the quantitative team early in the process.

- Align on the objectives and where the qualitative can help fill in gaps and provide context for designing the questionnaire.

- Have regular check-ins and collaborative planning to ensure everyone is on the same page.

- Efficient

- Budgets and timelines for pre-segmentation qualitative work are typically limited.

- In this case, choose methods that are quick and cost- effective, allowing the majority of the qualitative budget to be allocated to the post-segmentation phase.

- Inclusive

- At this stage, you are looking to inform the quant questionnaire development and ensure that the full range of up-to-date category issues, attitudes, needs, and behaviors are captured. As such, it is important to include a full range of category-user participants within your study. Depending on the category, this may mean recruiting across ages/life stages, income levels, and geographies and including those who have differing levels of engagement and knowledge in the category.

Potential Qualitative Approaches When Time and Budget Are Limited

- “Super Group” Work Sessions

- Recruit 16–20 category-user participants representing a range of factors, such as life stage, category engagement, socio-economic factors, or other relevant drivers for an in-person two-hour session.

- Set up a large, flexible meeting space with flip charts and markers.

- Divide participants into four to five groups based on a specific factor relevant to the category.

- Have each group brainstorm and discuss what’s important to them in the category. Assign one person to record key factors on the flip chart.

- Switch the breakout groups around based on different factors and continue brainstorming using a range of prompts and techniques.

- Consider involving the quant team in the session; they may serve as note-takers or even help as breakout group flip chart facilitators.

- By the end of the session, you will have identified emerging trends, hot-button issues, and collected a large range of opinions from diverse consumers that can be synthesized to inform the quant questionnaire.

Often, one Super Group is adequate to inform the questionnaire, but if there are broad geographic differences, consider conducting the groups in two to three markets. This approach can efficiently and effectively generate a range of category attitudes and needs, brand perceptions, as well as consumer language to include in the quant questionnaire.

- Interactive Discussion Boards Similar results can be achieved through an online discussion board. Here is a way to set it up:

- Plan exercises that capture the range of attitudes and needs with easy fill-in-the-blank formats.

- Provide opportunities for participants to add to and comment on others’ responses to help uncover differences in behaviors and approaches.

- Keep the board simple; limit it to no more than two sections that can be completed in less than 75 minutes.

No matter your approach, keep the following points in mind to help make your pre-segmentation work more effective.

- Engage the Quantitative Team: Encourage the quant team to actively participate. Have them take notes or even help facilitate sessions. Their direct involvement will help make the qualitative insights more useful for designing the quantitative questionnaire.

- Hold an Insight Sharing Session: After the qualitative fields, organize a team meeting within a few days to share findings and insights. Instead of writing up a formal report, use this session to discuss key insights and make sure everyone is aligned on the learnings. The quick turnaround keeps the information fresh and actionable to inform the quant questionnaire.

- Review the Quantitative Questionnaire: Once the quant team drafts the questionnaire, review it thoroughly. Add any additional perspectives or missing attributes, drivers, or factors you think are important to capture for accurate segmentation.

This will help strengthen the inputs of the segmentation study, leading to more informed and accurate segments.

Post-Segmentation Qualitative: Bringing the Segments to Life

Once a quantitative segmentation study is completed, a follow-up qualitative study is a critical step in bringing the segments to life. It is key to understanding the real people behind the data and providing clearer insights that can drive more effective marketing strategies.

When planning the qualitative approach, consider the following:

- Focus on only the High-Opportunity Segments: for the most efficient use of the budget, recommend to stakeholders that you concentrate only on the key segments with the most potential for the brand. Ideally, focus on bringing no more than three to four of the highest-opportunity segments to life, as this is where the brand’s marketing efforts will be most impactful.

- Collaborate with Stakeholders and the Quantitative Team: Work closely with stakeholders and the quant team to identify areas where deeper insights are needed. This could include areas for marketing planning or other strategic needs. This collaboration helps ensure all parties are aligned, which can maximize the value of the qual efforts.

- Determine Stakeholder Involvement: Determine the level of involvement stakeholders want during fieldwork. If they are interested in observing the fieldwork, plan how they can be actively engaged. Consider providing worksheets or note-taking formats they can fill out with their observations and implications for the brand. These can be especially useful during the analysis phase.

- Plan for Deliverables: Plan ahead on how the findings will be shared and utilized. Work with the stakeholders to decide on the most effective deliverable formats, such as video profiles, one-pagers, or team-sharing sessions. Make sure your approach will capture insights in a format that can be shared in a meaningful and actionable way.

- Plan for Budget and Timing: Naturally, any approach should be planned within the given budget and timing constraints. Make sure your approach will effectively capture the necessary segment insights within a realistic timeline.

Post-Segmentation Qualitative: Target Illumination Is Method Agnostic

There is no specific method that works best for bringing post-segmentation targets to life. Your approach should be flexible and adaptable to fit the unique characteristics of the segment and category. The end goal is a vivid, compelling picture of each segment that can result in actionable insights for the brand.

- Focus on Situation-Dependent: Choose methods based on budget, stakeholder needs, timing, and category specifics.

- For example, a B2B tech brand targeting small-business segments might be best served with virtual in-depth interviews (IDIs).

- Conversely, an automotive brand might benefit more from an ethnographic “drive-along” approach, where you might learn more by interacting with participants in context.

- Bring Important Segment-Distinguishing Factors to Life: Look for ways to capture critical aspects, such as unmet needs, preferences, and purchase drivers and deterrents.

- For instance, for a kitchen appliance brand, you could focus on how different segments prepare meals. Conduct in-home visits where participants can demonstrate their cooking routines, showcasing their appliance usage, favorite features, frustrations, and unmet needs.

- For a paint brand, you might explore how different segments approach choosing colors and paint types. An online discussion board may be a more cost-effective way to capture a “project walkthrough” where participants can show off their completed paint projects via photos or video, discuss their selection process, and share any challenges they encountered.

- Capture Real Voices and Artifacts: Be sure your approach will allow you to gather the authentic voices, as well as tangible artifacts, to illustrate and bring to life the segments.

- Capture photos and videos of participants interacting with the product or category. For a home improvement retailer, you might document how DIY enthusiasts plan and execute their projects, capturing their workspace set-ups, tool selections, and project stages.

- Collect quotes and stories that highlight key insights of each segment. For a fashion brand, you could compile narratives about participants’ shopping experiences, style choices, and wardrobe management, illustrating the emotional and practical aspects of their fashion decisions.

Post-Segmentation Qualitative: Sharing Segments for Impact and Usability

Planning ahead to tailor the findings to your stakeholders’ needs will help to ensure the work is well-received and useful within the organization. Here are a few considerations for making your deliverables compelling and effective.

- Engage the Team with a Stakeholder Work Session

- Create surroundings that immerse the attendees in the segments, using posters, artifacts, and other visual aids collected in the field.

- Encourage stakeholders to participate in the process through pre-meeting assignments to prepare for activities, such as role-playing exercises (e.g., “I am…” scenarios) to deepen their understanding and connection to the segments.

- Deliverables:

- Tailor the format of your deliverables to how the segment information will be shared within the organization. This might include booklets, online profiles, mini-videos, or even podcasts.

- Ensure the deliverables are grounded in the segment’s world and how they relate to the category, providing a rich, contextual understanding of each segment.

- As budget allows, bring in a designer or content strategist to add significant value in helping make the segment profiles visually engaging and impactful.

Final Thoughts

Segmentation work can be rewarding as it taps into what we do best as qualitative researchers: diving deeply into people’s motivations and emotions and making these insights practical and strategic. There is satisfaction in turning data-based profiles into vivid, actionable human insights.

With thorough planning and close collaboration with stakeholders, you can smoothly deliver valuable insights that brands need to create targeted and successful marketing strategies. Success hinges on being flexible, creative, and having a deep understanding of the segments you are bringing to life.

Happy segmenting, and may your insights always be illuminating!