Multicultural segments typically skew differently compared to the general market in some consumer categories. This may include differences in behaviors, attitudes, and beliefs, mostly associated with a population’s cultural background. Companies with good multicultural ambassadors make sure to include these segments in their research scope to have a more complete and accurate picture of the market they work in, resulting in more actionable insights, which turn into business strategies and ultimately increasing their ROI.

Unfortunately, companies don’t always have the expertise required to successfully tap into these segments, resulting in disastrous research results that omit critical insights. The purpose of this article is to share tips, tricks, and tools to help you guide clients when working on a research project involving a multicultural segment, with a particular focus on Hispanics.

Identity and Importance of the Hispanic Market

In the United States, Hispanics are those who share a cultural background that involves certain traits of Latin America. These might include their country of origin (either first-generation immigrants or ancestry); language predominance and preference in day-to-day activities (Spanish versus English); or behaviors and preferences that reflect specific cultural values.

If you are in the market research industry, and you are not considering this segment, you better get on the bandwagon or you might lose your share of a growing market. According to Pew Research, the Hispanic segment grew 57 percent between 2000 and 2014. By 2015, according to Pew Research, there were 56.5 million Hispanics in the United States, accounting for 17.6 percent of the total U.S. population, the country’s largest minority group.

Project Scoping

English or Spanish or Spanglish?

While scoping studies, I have had clients who want all of a study conducted in English. Because 30 percent of the Hispanic population that lives in the U.S. only speaks Spanish, a study that only targets English-speaking Hispanics is not inclusive. Spanish/English speakers account for 40 percent of the entire Hispanic population. Hispanics from this group are referred to as the bicultural segment. They are chameleon-like; they speak English and Spanish equally and navigate between cultures depending on where they are, who they are with, and their needs. As a result, their opinions will be highly skewed toward a general market (acculturated) view when they are set to respond in an acculturated (general market) environment.

A good solution to this dilemma is to break into mini-groups or to conduct in-depth interviews (IDIs) with those who are bicultural or Spanish speakers and have a bilingual moderator lead the discussions with them in Spanish or more commonly Spanglish. If working with an online community forum/platform, consider creating an alternative space where respondents are encouraged to respond in their language of preference.

Given the diversity of Hispanics in the U.S. based on acculturation, researchers shouldn’t just recruit the minimum Hispanic quotas within a general market sample. By doing so, they may miss out on identifying important insights from this diverse segment.

Groups or IDIs?

Hispanics love to talk and share, as long as they are given the right space to freely do so, but they need to feel welcomed and included. Hispanics thrive in group settings; they enjoy sharing stories and experiences with others like themselves. As a result, methodologies like focus groups and in-home party groups, where the host invites a few friends, work well. These methodologies typically result in having a group of high-energy respondents who provide enormous value and insights for an end-client. The only caveat for organizing groups versus IDIs is if you are dealing with a topic that might be considered sensitive or taboo, then definitely use the IDI approach.

Where can I find them?

Where can I find them?

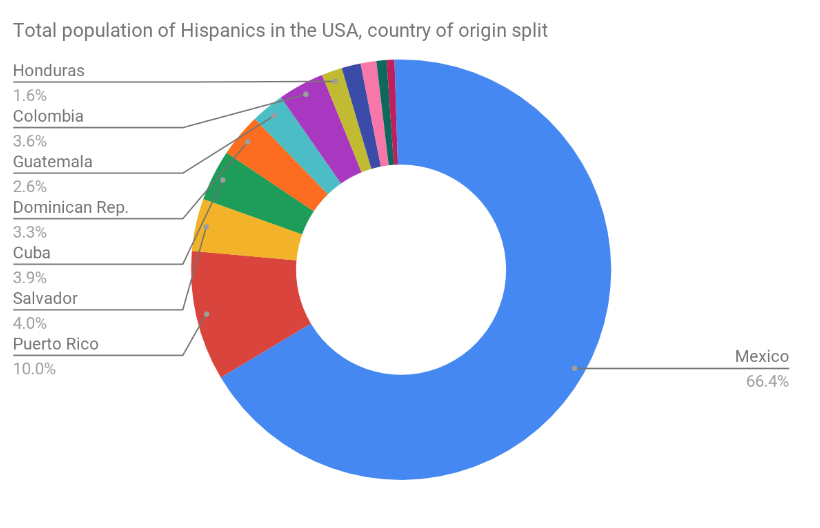

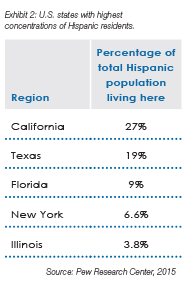

U.S. Hispanics come from a number of countries of origin. (See exhibit 1.) When scoping a Hispanic study, the best approach is to try to tap into the different populations that make up this group. In the United States, the composition of the population is distributed across the country with a stronger incidence in the west (mainly in California) and south (mainly in Texas and Florida). (See Exhibit 2.) In Florida, this segment is primarily of Cuban, South American, and Caribbean descent, while the population in Texas and California skews more toward Mexican. In New York, it is primarily Puerto Rican.

Online or in-person?

Online or in-person?

Online research has many advantages. The number of tools available allows researchers to be creative and to use a variety of approaches (from real-time IDIs or focus groups to online community boards) and to meet with Hispanics across the country with just a click. You can connect with Cubans in Miami, Puerto Ricans in New York, and Mexicans in Chicago without the hassles and expenses involved with traveling. Having said that, Pew Research reported in 2019 that, while 79 percent of Hispanics own a smartphone, only 61 percent have home broadband and only 57 percent own a laptop or computer. Additionally, some 25 percent of Hispanics report they only use the internet through their smartphones. So, when planning to conduct online IDIs or focus groups, make sure to include specific notes to your recruiters to do tech check-ups during the recruitment process and to remind respondents to be in a quiet space for their session (i.e. not a coffee shop). If you are planning on engaging respondents in an online community board, keep in mind that a high percentage of Hispanic participants might prefer to access and participate directly from their phones. This can impact the length and depth of text-based responses given the time it requires to enter information on a phone versus a computer.

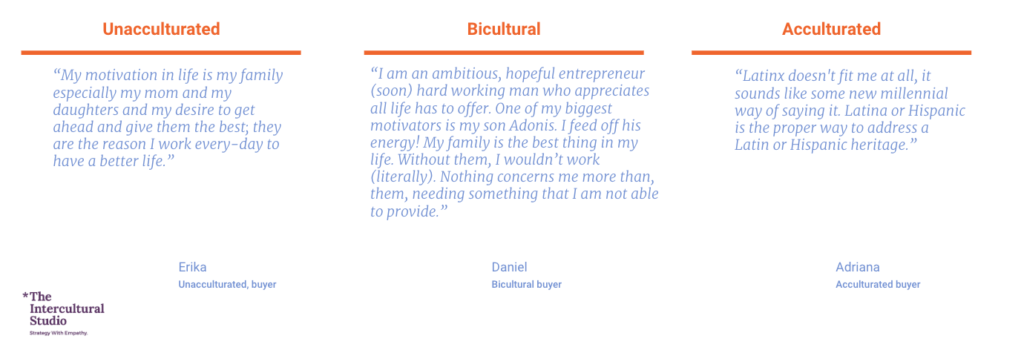

Recruitment

The right screener and recruiting partner will help you identify an incredible sample of respondents and improve your project. Make sure your screener is developed by either an experienced moderator or an experienced recruiting partner who can identify key questions needed to segment Hispanic respondents appropriately. Using the appropriate acculturation criteria (see Exhibit 3) will help you avoid recruiting mistakes. For example, avoid having a Spanish language dominant respondent in a group with English language dominant speakers so they will not feel ostracized. Also, work to properly identify those who have a close connection to the Hispanic culture versus those who mention their great-grandparents were Mexicans before California became part of the U.S. This last type of respondent would be a better fit for a general market study given that most of their experiences and connections are more closely tied to the American way of life.

In the multicultural market research world, there is an algorithm (a set of questions that are applied during the screening call) that will help you get the best results. This set of questions typically includes uncovering the acculturation level of the respondent.

Acculturation model and basic screener questions

These questions can include:

- Where were they born? (U.S. or other country? According to Pew Research Center in 2018, about 35% of the Hispanic population was born outside the U.S.)

- If born in another country, is their birth country in Latin America/Caribbean/Spain?

- If born outside of the U.S., how long have they lived in the U.S.?

- What is their main language used at home, at work, and for media consumption?

While not perfect, this set of questions will provide you an approximation of the level of acculturation of the respondent.

- Unacculturated: Someone who is Spanish-language dominant, most likely foreign-born, often first-generation.

- Bicultural: Is fully bilingual and can be foreign-born or U.S.-born, can be first or second generation.

- Acculturated: Has been in the U.S. for more than ten years or was born here, speaks mostly English, can be from a second- or a third-generation family.

Guide Development and Moderation

The Spanish language values context and oral storytelling, rather than providing a straight answer. A typical response from a person with this background (even when responding in English) will first provide context to properly build up their argument, then the main point will come much later in their response. Moderators and clients need to be aware of this and to listen carefully so that they understand the complete answers and avoid jumping in before respondents are able to communicate their points. This is opposite of what typically happens in the English language, where the main point is immediately communicated and then followed by details that support the argument. Consider this example.

Moderator: “How do you feel about this concept?”

Concept: To be bold is to live a life without regrets.

U.S. respondent: “This concept makes me feel wanting to be more adventurous and wondering if I should take more risks. For example, should I just go on a last-minute vacation or a weekend trip without much planning or try a new hobby? Looks like it might be a fun experiment.”

Hispanic/Latin American respondent: “When I got my first job, I felt insecure at first because I was not sure if I was going to like it and feel comfortable in an environment with many challenges. However, I took a leap of faith and ended up being very successful at the job and making many friends. This concept reminds me of that experience, and that is why I feel it is important to live without regrets.”

Also, it is important to be aware that many Hispanics born outside of the U.S. had a different education system which dramatically impacted their learning and communication style. As a result, questions regarding broad concepts require more specific contextualization and sometimes specific examples or projective techniques. I strongly suggest thinking about these big issues during the design of the guide. Include contexts and examples in the probing questions if your questions are asking about big concepts and encourage the moderator to probe with this in mind. Consider projective techniques that allow respondents to create associations and to find specific examples that explain their thought process behind an idea. For example:

Moderator in a general market group:

Question: “What does your morning routine look like?”

Probe: “What emotions are involved? Why?”

Moderator in a Hispanic group: (NOTE—The moderator will be prepared with a set of images that can be used by respondents.)

Instruction: “Here is a set of images available for you to pick and choose. Please choose the ones that you connect with the most regarding how you feel about your morning routine.”

Question: “Why did you choose that image?”

Probe: What does it remind you of? How do you feel in that moment? Why?

Additionally, if you are designing a homework activity or an online discussion board, avoid text-only answers. Instead, try to include options for the respondents to express themselves with images/photos/videos, followed by a text-input space for them to explain what was shared in the photos/images/videos.

Finally, because the Hispanic segment is so diverse, there is a strong probability that your respondents don’t call themselves “Hispanics” or “Latinx.” They may identify as Puerto Ricans, Mexicans, Cubans and some don’t ever think about their identity through these lenses. As a result, it becomes extremely difficult for them to provide a good answer to the question “How do you think that being Hispanic influences you in your day-to-day life?” or “Why do you think Latinx do Y or Z?” It is probably easier for participants if you ask, “How do you feel your cultural background (or your experience from your country of origin. if applicable) influences Y or Z?” That way, you give them a more specific guidance on what experiences they can think about when providing an answer.

Debriefing and Reporting

While interpreting responses and the data collected, do so wearing a cultural lens and considering the level of acculturation. Some consider this to be an art, but it is more like a set of frameworks and models. While values change and evolve, having an overall idea of what this framework looks like will help you navigate the multicultural setting. Here are a few examples of relevant values in the Hispanic community:

- Collectivism: Hispanics tend

to prefer group activities and give more importance to social acceptance than individualism. - Pride and Progress: Hispanics value education and hard work with the idea of achieving a better lifestyle than their parents or their families from their countries of origin.

- Spirituality: Which is the result of the syncretism between Catholicism/Christianity on the one hand and the traditional indigenous spiritual beliefs and practices that remain ingrained within the cultures across Latin America on the other.

- Machismo/Marianismo: This set of values refer to the more traditional gender roles where men are expected to behave like the dominant and strong pillar of a household while women are expected to be just like the Virgin Mary, caring and nurturing. While younger generations are moving away from these traditional roles, older generations and conservative groups may still adhere to these mores.

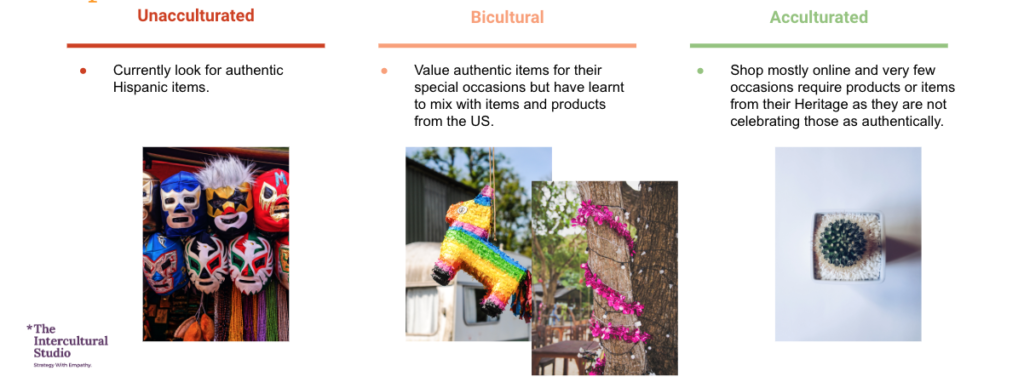

Every behavior, attitude, or preference has an underlying value. Being able to make these connections will allow you to identify key insights and to create a compelling story. For example, in a recent study, one of the main goals was to help the client understand what “cultural-relevant products” meant for different respondents, by acculturation level. Before presenting specific actionable insights to the team, I first focused on explaining how the acculturation model brings values to life in different ways and levels of expression. I like to provide quotes that bring the values to life and finish with very specific examples, so things are not left in the conceptualization level. In Exhibit 4, the examples show specific images of how a “cultural-relevant product” looked for each segment. This is a clear example that an actionable insight resulting from a Hispanic study goes beyond language.

Summary

Multicultural segments, specifically Hispanics, are complex and constantly evolving. The current composition of the Hispanic population in the United States suggests that the segment is gaining momentum and should be considered in research studies. A clear understanding of the group demographics and the overarching value and beliefs systems that underlie their attitudes, behaviors, and preferences can help researchers when scoping projects, recruiting, designing a discussion guide, moderating, debriefing, and reporting clear actionable insights to clients.

References:

“Statistical portrait of Hispanics in the United States” Antonio Flores, Gustavo López, and Jynnah Radford, 2015

Be the first to comment